- Dec 24, 2025

US Technology and Software Exports: A Digital Trade Powerhouse

The US is one of the world's most important "digital sellers" since it sells code, cloud, data knowledge, and intellectual property on a large scale, in addition to planes, cars, and chemicals.

In today's world of trade, software upgrades can move faster than ships, and a product can be "delivered" as an API, a subscription, or an enterprise license instead of a physical box.

This change has made technology and software a key part of the U.S. export strength, especially through cross-border services like cloud computing, IT consulting, licensing intellectual property, and research-driven innovation.It's not just one type of technology that makes U.S. exports so strong; it's a whole ecosystem. A U.S. company might design semiconductors in the U.S., host services in global cloud regions, license IP to partners in other countries, and offer remote cybersecurity monitoring to clients throughout the world. These services are often all part of the same business partnership. This export engine is also strong.

Even when tariffs or transportation problems hit commodities trade, digitally supplied services can keep growing since they are delivered over networks. What do "technology and software exports" mean?"Tech exports" in trade numbers don't just mean phones and servers. A lot of it comes from services, especially those that include remote distribution, digital platforms, and labor that requires a lot of knowledge.

Some of the Most Important Building Blocks Are

Telecommunications, computer, and information services: IT services, computing solutions, and data-related services that are available in more than one country.Digital and electronic services: a larger term that is typically used in industry-focused reporting to cover numerous activities that take place through digital means.

Licensing Fees and Royalties: From software, patents, trademarks, and other IP assets are examples of charges for using intellectual property (IP). Research and Development (R&D) Services: When U.S. companies do research, come up with new ideas, or make R&D output for clients in other countries. These are all part of the "software-led" side of U.S. trade, where value is found in code, platforms, and ideas instead of physical goods.

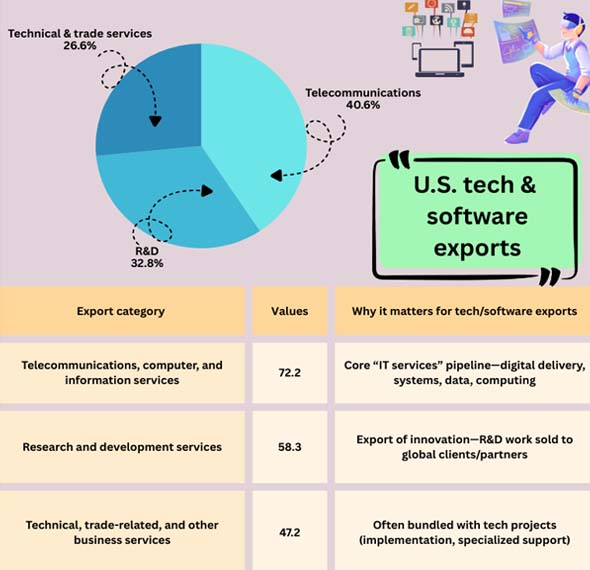

The Size: Services that use technology are a big part of exports. Recent statistics on cross-border services trade demonstrates that services related to technology are already a big and growing part of U.S. exports. For instance, exports of telecommunications, computer, and information services went up from $66.2 billion in 2022 to $72.2 billion in 2023, a big jump from one year to the next. During the same time, exports of research and development services were big and steady ($57.8 billion in 2022 and $58.3 billion in 2023). This shows that innovation is a tradable U.S.output.

IP Monetization is another Important Source

Licensing and royalty income, which is money that companies charge for using their intellectual property, helps explain how U.S. software and computer companies may make money even when they don't ship their "products." This is especially relevant for enterprise software, SaaS models, developer tools, and embedded software used internationally.

Why the World Continues Wanting more U.S. Digital Exports

Cloud use and "subscription economies" are two things that are keeping demand for U.S. technology and software exports high.More and more, businesses around the world are buying software as subscriptions and managed services instead of one-time licenses. As per USA Import Data by Import Globals, This immediately helps with regular cross-border exports because the money is related to continued access, maintenance, and improvements, which are generally done remotely.

Cybersecurity as a Permanent Line Item

It's not optional to have security anymore. Many businesses around the world depend on U.S.-based security organizations for threat intelligence, monitoring, incident response, and identity tools. These are services that are organically exported over networks. Bringing businesses up to date and leveraging AI to make work easier.

According to USA Import Shipment Data by Import Globals, Companies all over the world are moving to the cloud, modernizing aging systems, and integrating AI in their work. The U.S. is particularly essential because it contains a lot of hyperscalers, enterprise SaaS firms, and tool ecosystems.

Business Models that Rely Heavily on IP

Even when the "delivery" is instant, software and digital platforms can nevertheless export value. IP-based earnings, such as royalties, licenses, and usage fees, enable the U.S. get value from technology that spreads around the world.

What the U.S. does Well: Qualities that Build on Each other over Time

1) Strong Product Ecosystems

Platforms lure people in: developer tools, markets, integrations, and partner networks make it tougher to switch and encourage people to keep buying from abroad.

2) Specialization that is Worth a Lot

When the U.S. exports, they usually focus on complicated, high-margin services like corporate software, cloud infrastructure, advanced analytics, cybersecurity, and IP licensing.

3) Innovation Pipelines

Strong R&D exports (and R&D capabilities) show a bigger truth: the U.S. often sends not only the finished software, but also the research and design skills that went into making it.

4) Size and Dependability

Big U.S. tech companies can provide around the world with uniform service standards, compliance tools, and redundancy in several regions, which is very important for international purchasers.

What Could Slow Down Progress?

Even a strong person has problems: Digital protectionism and limitations about where data can be stored can make it more expensive to comply and impede cross-border delivery models. As per USA Export Data by Import Globals, Taxes and rules for digital services can make pricing and structuring more complicated. Geopolitical risk can change supply chains and push for "sovereign tech" rules. Talent and immigration restrictions can impact innovation and the capacity to implement global projects on a large scale.

The direction of travel is still clear: digital services are developing quickly all around the world, and the U.S. is in a good position to get a big piece of that growth. Import Globals is a leading data provider of USA Import Export Trade Data.

FAQs

Que. Is software a "goods export" or a "services export"?

Ans. As per USA Export Import Global Trade Data by Import Globals, When sold as SaaS, licensing, cloud services, or remote delivery, they are often considered services exports.

Que. What is the most direct trade category for IT exports from the U.S.?

Ans. One of the most similar standard categories is "telecommunications, computer, and information services."

Que. Why are IP fees important for IT exports?

Ans. They make money by licensing software and other intellectual property around the world, even if they don't send anything.

Que. Do R&D services actually count as exports?

Ans. Yes, when U.S. companies do research and development work for companies in other countries, it counts as services trade.

Que. Where to get detailed USA Import Export Global Data?

Ans. Explore www.importglobals.com.