- Jan 23, 2026

Top Commodities Driving Iran's Foreign Trade and How Sanctions Shift Markets

The easiest way to understand Iran's commerce with other countries in 2025–26 is to think of it as two economies moving in the same direction. One is the energy and commodities engine (crude, condensate, refined goods, petrochemicals, metals) that creates money and keeps industry going.

The Most Important Goods for Iran's Foreign Trade in 2025–26, and How Sanctions Change the Markets

The other is the "everyday economy" import stream, which brings in things like machinery, electronics, pharmaceuticals, grains, and other industrial inputs. This stream keeps businesses going and households full with supplies. As per Iran Import Data by Import Globals, sanctions link these two worlds by selecting who Iran can sell to, how it gets paid, and which options are still open.

The ultimate result is a trade system that can handle a lot of volume, but is continuously being re-priced, re-routed, and re-branded. In 2025, Iran's crude oil exports were still the most essential thing for the balance of payments and the government's budget. At the same time, non-oil exports, especially metals and petrochemicals, remained a second pillar. These exports were often more varied in terms of what they were, but they were still at risk of shipping, insurance, banking, and secondary sanctions. By early 2026, the market was also revealing a pattern of sanctions that repeated over and over again: as the risk of enforcement goes up, buyers gather together, discounts are larger, and "storage and stealth logistics" become a bigger part of the system.

1) The Export Core: First Energy, Then Industrial Goods

Crude Oil and Condensate Are the Main Exports

Iran's main exports are mainly crude oil and condensate. China was by far the most important site for Iran's seaborne oil to go in 2025. Most of it went to independent refiners who are more willing to bear the risk of sanctions in exchange for lower prices. The most essential thing is the price. As per Iran Export Data by Import Globals, when sanctions pressure rises, the discount to benchmark crudes normally gets larger, which keeps barrels flowing. But this means that each barrel will bring in less money and that there will be greater costs for transactions (middlemen, ship-to-ship transfers, longer voyages).

From 2025 to early 2026, the rise in floating storage was a big deal. When people stop buying or shipping gets tight, crude oil that is still being made has to "wait" somewhere, generally at sea, until it is safe to offload it. This is one of the clearest indicators that sanctions and geopolitics affect not just the total amount of exports, but also the time and cash conversion.

Refined goods and LPG: Making Money From Downstream Capacity

When crude marketing isn't going well, refined commodities and LPG might be other methods to make money, especially in places where there is a lot of demand. But these channels can also be checked: product tankers, cargo papers, port calls, and payments are all sites where enforcement can happen. As per Iran Trade Data by Import Globals, when it's hard to sell crude, refined products can act as a "pressure valve," but they don't usually replace the amount of crude.

Petrochemicals: Iran's Export Machine That Works Around Sanctions

Petrochemicals are the most valuable and strategically important group of exports that aren't oil. Iran exports a lot of different chemicals, such as methanol, urea, and other fertilizers; polyethylene and other polymers; aromatics; and chemical intermediates. Petrochemicals are powerful because they have a lot of different products and a lot of people want them in Asia. They are weak because their trade depends on access to the sea, trading houses, and settlement systems that are tied to the dollar. In 2025–26, networks that help with petrochemical trade and its financing were punished, which made more transactions go via many middlemen. As per Iran Customs Data by Import Globals, this raised costs and made payments take longer. When prices go down, buyers usually look for even bigger discounts or switch to other suppliers till the price difference is still big.

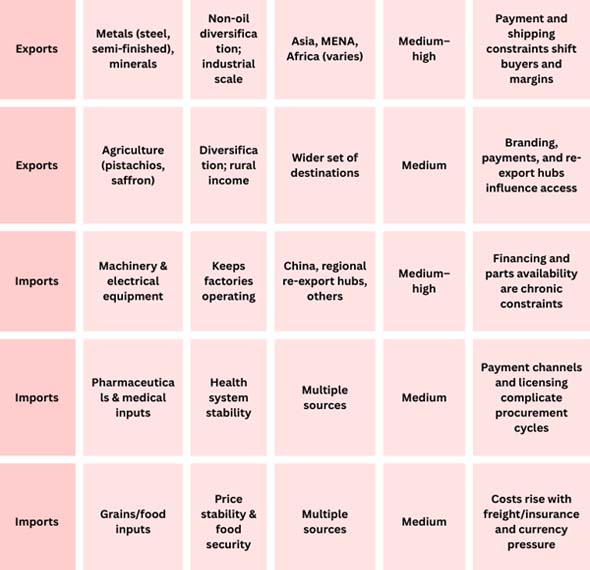

Exported Metals and Minerals Including Steel, Iron, and Copper Under Friction

Minerals and metals, such as steel and semi-finished goods, are other important exports that don't involve oil. Most of the time, these shipments go to markets in Asia and the area around it. Changing their routes is easier than it is for some other kinds of goods. But metals have their own problems, such getting to ports and shipping, insurers who are nervous, and problems with payments. In the real world, sanctions don't always stop metals from leaving the country. Instead, they typically adjust which importers can pay on time and how much money exporters have to give up.

Farming and Specialized Exports, Such as Saffron, Pistachios, and More

Pistachios and saffron are two examples of agricultural exports that are still important for rural income and diversification, but they are not as substantial as oil, petrochemicals, and metals. Sanctions also have a role here, especially through payments, logistics, and branding/packaging pathways (where "country of origin" and re-export paths might effect market access).

2) The Import Core: Keeping Business Going Despite Limitations

Iran's imports are made up of products that people and businesses need. Machinery and electrical items are always near the top since Iran's companies need parts, electronics, and equipment from other countries. As per Iran Shipments Data by Import Globals, medicines and medical supplies are still crucial because they can't always be replaced. Grains and food inputs are significant since the amount of food in the US changes with the weather, water shortages, and the need for prices to stay steady.

Sanctions can make it tougher for banks to process payments, which can cut down on the number of suppliers and raise prices.

- higher shipping and insurance charges,

- longer and more difficult paths,

- reliance on middlemen and places where goods are sent back out.

- Even when commerce stays the same, this makes imports pay a "hidden tax."

3) What Sanctions Change: Not Just the Amounts, But the Market Structure

In 2025–26, sanctions have moved markets in four different ways:

Many Buyers

When the risk of enforcement rises, trade shrinks to a smaller set of buyers and middlemen. For crude, this means that a lot of it has to go to China.

The Economics of Sales

Cargoes from Iran frequently clear at lower prices to make up for the risk. Higher risk means lower netbacks since there are more fees and bigger discounts.

Changing the Way Things Work

When there is more inspection, ship-to-ship transfers, lengthier routes, floating storage, and more complicated documentation become more common.

Problems With Money and Paying

Even if a consumer enjoys the item, the hardest part can be paying for it.If networks and facilitators are punished, it could be tougher to get money and more likely that you'll have to deal with the other side.

4) What to Watch Until 2026

As per Iran Import Data by Import Globals, China's ability to take in crude oil and the risk of enforcement: If enforcement gets stricter or refiners run into trouble, crude imports can slow down, even if there is demand. This might mean more storage on the water and better deals.

People are really interested in networks for petrochemicals.If sanctions are put in place against facilitators, the petrochemical trade could move to more expensive channels, which could hurt sales and profits.

How well do items that aren't oil sell? You can still sell metals and chemicals, but how much you gain depends a lot on how much it costs to ship them and how reliable payments are.

Conclusion

Inflation pressure vs. import resilience: Machinery, drugs, and grains will keep pouring in, but the "hidden sanctions tax" can make them more expensive and undermine the local economy.

In 2025–26, Iran's commerce will be clear: crude oil and condensate will come first, followed by petrochemicals and metals, which are important non-oil imports that keep the economy going. Sanctions don't only stop trade; they transform it. They bring buyers together, give higher discounts, change how things are supplied, and make payments take longer. Iran's foreign commerce is continually changing, which is what makes it special. The same things keep moving, but the market structure surrounding them continues changing. Import Globals is a leading data provider of Iran Import Export Trade Data.

FAQs

Que. What will Iran's biggest export be in 2025–26?

Ans. Most of the oil and condensate that is shipped by sea goes to China, and they are still the major exports.

Que. What else does Iran sell except oil?

Ans. Metals (steel and semi-finished items) and petrochemicals (methanol, urea/fertilizers, and polymers) are the main things that are exported that aren't oil.

Que. What goods does Iran need to import the most?

Ans. For pricing to be stable and industry to keep going, machinery and electrical items, medicines and medical supplies, grains and food supplies, and grains and food supplies are all highly vital.

Que. How do sanctions "shift markets" instead of stopping trade?

Ans. They modify who trades and how much it costs by driving business toward fewer buyers, bigger discounts, more middlemen, longer routes, and worse payment and financing terms.

Que. Where to get detailed Iran Trade Data?

Ans. Visit www.importglobals.com.