- May 26, 2025

Discover the Crude Oil’s Share in Russia’s Total Exports: Unlock the Latest Trends and Strategies

Recent trade statistics have reported that the total crude oil export from the nation stands at 5.94 million barrels per day. Although there is a big decline in the production rate by 3% from the previous year, but still most production capacities are still on the go to counter the revenue rate positively. Russia has recorded a shift in its shipment rate of crude oil as the trade rates with the regions of closer geographical proximity have come across recent fluctuations, among which China accounts for almost 47% of the crude oil exports.

Crude oil, with its strong presence in the export economy of Russia, accounts for almost 46% of the total export revenue shared. Almost half of the entire export economy depends on crude oil and petroleum products. That is why the strategic pricing range continues to solidify the strong demand from major buyers like China and India.

The Government Initiatives Supporting the Crude Oil Exports of Russia in 2024

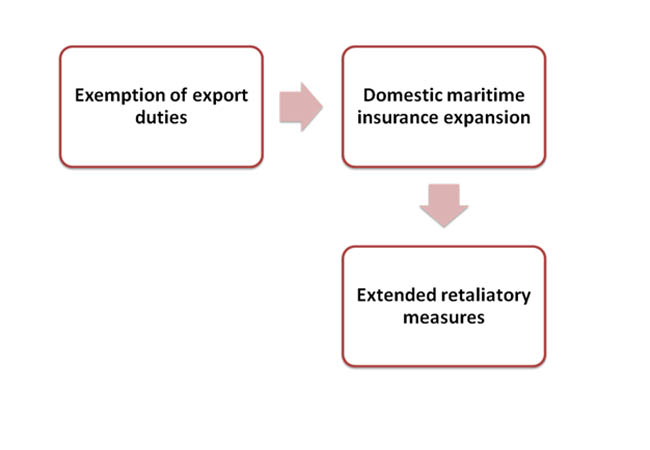

The government strategies implemented by the Russian Federation practically aim at sustainability in crude oil exports, mounting international sanctions, leading to shifting global energy markets. As per the Russian trade data, the top three government initiatives supporting the export of crude oil from the nation in 2024 are,

1. Exemption of Export Duties - The most crucial government initiative supporting the overall export of crude oil from Russia in 2024 is the abolition of export duties from crude oil. This initiative was mainly implemented for streamlining the oil taxation system to enhance the competitiveness of Russian oil in international trade. The removal of these duties results in affordable pricing strategies offered to investors who are looking for sustainable trade practices with targeted commodities.

2. Domestic Maritime Insurance Expansion - Following the duty's exemption on crude oil, another major initiative taken by the Russian Federation is the expansion of its domestic insurance capabilities. The country has established three Russian insurers with a subsidiary from Sberbank to seek approval from India for maritime insurance. Such initiative aims to ensure relentless delivery of crude oil to key marketing regions for initiating trade bonds with the leading importers worldwide.

3. Extended Retaliatory Measures - Wrapping up, the third and the last government initiative in our list that highlights the crude oil export of Russia is the extension of retaliatory measures against the Western-imposed oil price till the end of 2024. These measures are mainly implemented to prohibit Russian oil exporters from complying with the cap. The proper implementation of such initiatives undermines the efficacy of the price cap and maintains a higher revenue rate from its overall oil exports.

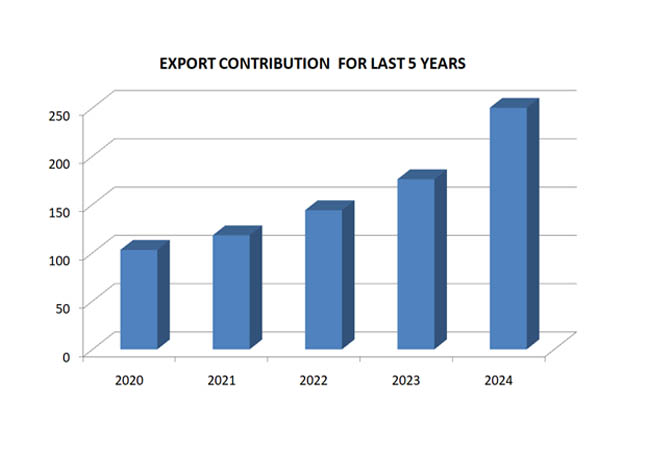

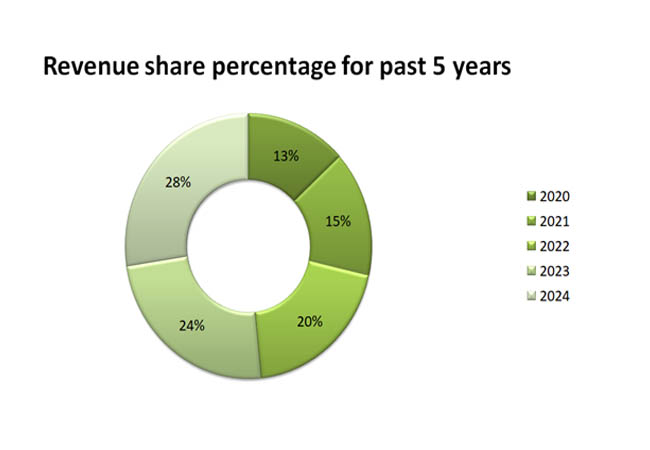

Russia's Crude Oil Export Contribution in the Economy for Last 5 Years

Before the present day, crude oil exports have been a critical pillar of the Russian economy over the last five years; The Navigation and International Sanctions and Shifting Energy Alliances have been key players in the export contribution of crude oil steadily contributing to a significant share in the national revenues, despite of the volatility in the global market. Here are the trade statistics of the crude oil export contribution to Russia's revenue generation for the last 5 years.

1. 2020 – Export trade rate – 102.9 billion US dollars: Annual revenue share – 12%

2. 2021 – Export trade rate – 118 billion US dollars: Annual revenue share – 14%

3. 2022 – Export trade rate – 144 billion US dollars: Annual revenue share – 18%

4. 2023 – Export trade rate – 176 billion US dollars: Annual revenue share – 22%

5. 2024 – Export trade rate – 250 billion US dollars: Annual revenue share – 25%

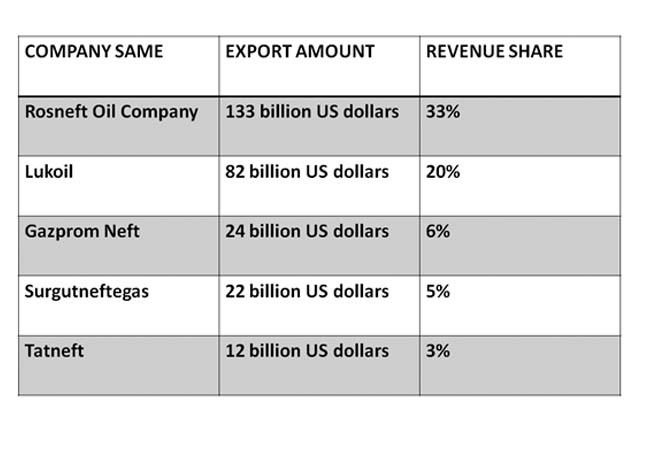

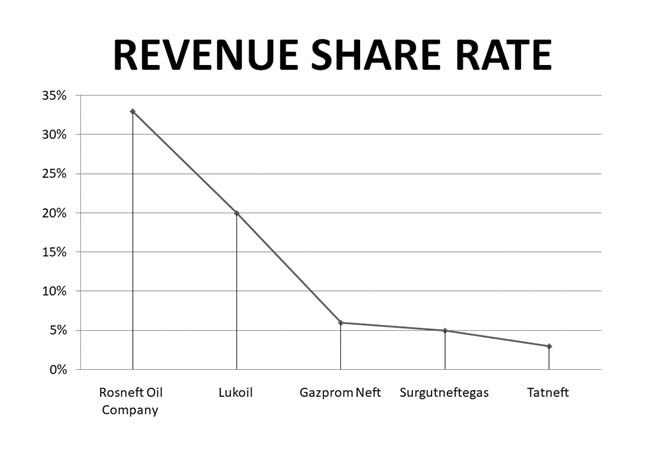

Top 5 Emerging Companies Supporting Russia’s Crude Oil Exports

Here’s a list of the top emerging companies supporting Russia’s crude oil exports

• Rosneft Oil Company – Export amount – 133 billion US dollars; revenue share – 33%

• Lukoil – Export amount – 82 billion US dollars; revenue share – 20%

• Gazprom Neft – Export amount – 24 billion US dollars; revenue share – 6%

• Surgutneftegas – Export amount – 22 billion US dollars; revenue share – 5%

• Tatneft – Export amount – 12 billion US dollars; revenue share – 3%

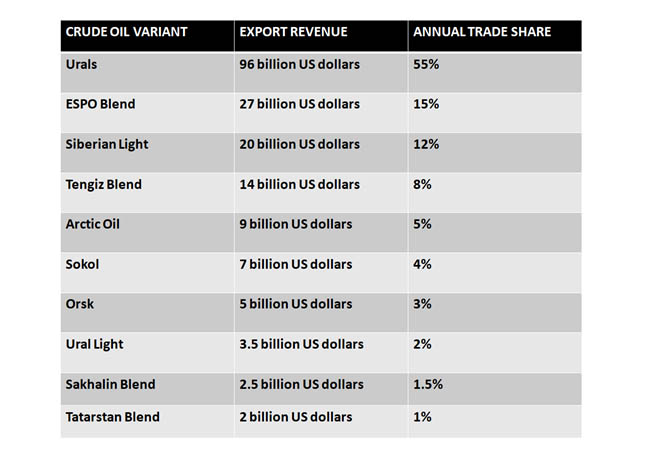

The Leading Variants of Crude Oil Exports From Russia in 2024

The trade firms have introduced a diversifying portfolio in the export services to counter the annual revenue rate positively. According to the Russia Customs Data, the top 10 exported variants of crude oil from the nation in 2024 are,

• Urals – Export revenue – 96 billion US dollars: Annual trade share – 55%

• ESPO Blend – Export revenue – 27 billion US dollars: Annual trade share – 15%

• Siberian Light – Export revenue – 20 billion US dollars: Annual trade share – 12%

• Tengiz Blend – Export revenue – 14 billion US dollars: Annual trade share – 8%

• Arctic Oil – Export revenue – 9 billion US dollars: Annual trade share – 5%

• Sokol – Export revenue – 7 billion US dollars: Annual trade share – 4%

• Orsk – Export revenue – 5 billion US dollars: Annual trade share – 3%

• Ural Light – Export revenue – 3.5 billion US dollars: Annual trade share – 2%

• Sakhalin Blend – Export revenue – 2.5 billion US dollars: Annual trade share – 1.5%

• Tatarstan Blend – Export revenue – 2 billion US dollars: Annual trade share – 1%

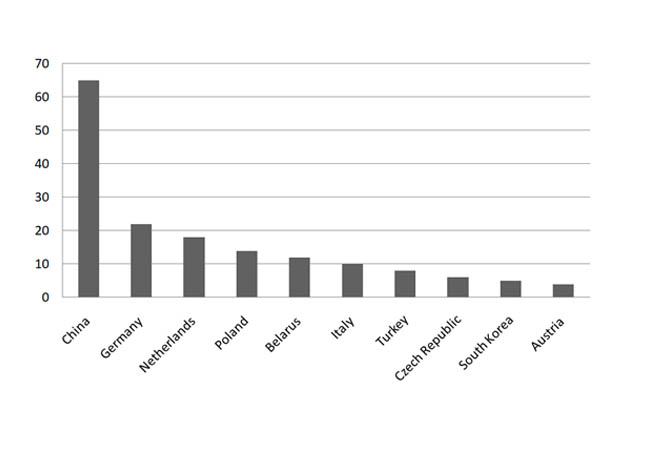

The Key Markets for Russian Crude Oil

The export of crude oil from Russia is gradually increasing because of its solidifying presence in the global market; the potential investors are also showing utmost engagement to renew their trade rates in this specific sector. The Russia Export Data enlists the below countries as the crucial markets for Russia’s crude oil,

• China – As per the China Import Data, the valuation of crude oil exports from Russia – 65 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020 – 83 million metric tons; (22 billion US dollars)

2. 2021– 79 million metric tons; ( 24 billion US dollars)

3. 2022 – 89 million metric tons; (38 billion US dollars)

4. 2023 – 106 million metric tons; (42 billion US dollars)

5. 2024 – 108 million metric tons; (65 billion US dollars)

• Germany – As per the Germany Import Data, the valuation of crude oil exports from Russia – 22 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020– 45million metric tons; ( 12 billion US dollars)

2. 2021 – 48 million metric tons; ( 12.74 billion US dollars)

3. 2022 – 52 million metric tons; ( 14 billion US dollars)

4. 2023 – 65 million metric tons; ( 18 billion US dollars)

5. 2024 – 78 million metric tons; ( 22 billion US dollars)

• Netherlands – As per the Netherlands Import Data, the valuation of crude oil exports from Russia – 18 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020– 32 million metric tons; ( 9 billion US dollars)

2. 2021– 38 million metric tons; ( 10.21 billion US dollars)

3. 2022– 41 million metric tons; ( 11 billion US dollars)

4. 2023– 54 million metric tons; ( 14 billion US dollars)

5. 2024– 62 million metric tons; ( 18 billion US dollars)

• Poland – As per the Poland Import Data, the valuation of crude oil exports from Russia – 14 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020 – 18 million metric tons: ( 8.7 billion US dollars)

2. 2021– 22 million metric tons: ( 9.8 billion US dollars)

3. 2022 – 28 million metric tons: ( 10.24 billion US dollars)

4. 2023 – 39 million metric tons: ( 11 billion US dollars)

5. 2024 – 52 million metric tons: ( 14 billion US dollars)

• Belarus – As per the Belarus Import Data, the valuation of crude oil exports from Russia – 12 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020 – 17 million metric tons: ( 6.5 billion US dollars)

2. 2021 – 25 million metric tons: ( 7.8 billion US dollars)

3. 2022 – 31 million metric tons: ( 8.21 billion US dollars)

4. 2023 – 34 million metric tons: ( 9.87 billion US dollars)

5. 2024 – 48 million metric tons: ( 12 billion US dollars)

• Italy – As per the Italy Import Data, the valuation of crude oil exports from Russia – 10 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020 – 9 million metric tons: ( 3.1 billion US dollars)

2. 2021 – 12 million metric tons: ( 4.7 billion US dollars)

3. 2022 – 18 million metric tons: ( 6.5 billion US dollars)

4. 2023 – 24 million metric tons: ( 7.84 billion US dollars)

5. 2024 – 38 million metric tons: ( 10 billion US dollars)

• Turkey – As per the Turkey Import Data, the valuation of crude oil exports from Russia – 8 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020 – 8.1 million metric tons: ( 2.5 billion US dollars)

2. 2021 – 9.87 million metric tons: ( 3.4 billion US dollars)

3. 2022 – 12 million metric tons: ( 4.71 billion US dollars)

4. 2023 – 25 million metric tons: ( 6.5 billion US dollars)

5. 2024 – 32 million metric tons: ( 8 billion US dollars)

• Czech Republic – As per the Czech Republic Import Data, the valuation of crude oil exports from Russia – 6 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020 – 7.65 million metric tons: ( 1.87 billion US dollars)

2. 2021 – 12.14 million metric tons: ( 3.5 billion US dollars)

3. 2022 – 15 million metric tons: ( 3.14 billion US dollars)

4. 2023 – 18 million metric tons: ( 4.7 billion US dollars)

5. 2024 – 27 million metric tons: ( 6 billion US dollars)

• South Korea – As per the South Korea Import Data, the valuation of crude oil exports from Russia – 5 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020 – 6 million metric tons: ( 1.56 billion US dollars)

2. 2021 – 10 million metric tons: ( 2.24 billion US dollars)

3. 2022 – 14 million metric tons: ( 3.17 billion US dollars)

4. 2023 – 18 million metric tons: ( 4.18 billion US dollars)

5. 2024 – 22 million metric tons: ( 5 billion US dollars)

• Austria – As per the Austria Import Data, the valuation of crude oil exports from Russia – 4 billion US dollars.

SHIFTING TRADE TRENDS

1. 2020– 5 million metric tons: ( 1.24 billion US dollars)

2. 2021– 9 million metric tons: ( 2.19 billion US dollars)

3. 2022 – 11 million metric tons: ( 2.28 billion US dollars)

4. 2023 – 15 million metric tons: ( 3.54 billion US dollars)

5. 2024 – 19 million metric tons: ( 4 billion US dollars)

CONCLUSION — Import Globals; Russia Export Data gives detailed insights into crude oil's contribution to the growing economy. Business holders can refer to the trade sheets to identify potential marketing regions for future investment.

FAQ’S

Que. What is the export trade value of crude oil from Russia in 2024?

Ans. The export trade value of crude oil from Russia in 2024 is 250 billion US dollars.

Que. Who is the top export trade partner of Russia for crude oil in 2024?

Ans. China is the top export trade partner of Russia for crude oil in 2024.

Que. What is the leading variant of crude oil exported from Russia in 2024?

Ans. Urals is one of the leading variants of crude oil exported from Russia in 2024.

Que. Name the top emerging company supporting Russia’s crude oil in 2024.

Ans. Rosneft Oil Company is the top emerging company supporting Russia’s crude oil in 2024.

Que. Where can you get a detailed trade analysis of Russia’s crude oil exports in 2024?

Ans. By subscribing to Import Globals, you can get a detailed trade analysis of Russia’s crude oil exports in 2024.