- Dec 25, 2025

Long Term Outlook for Denmark’s Export-Driven Economy

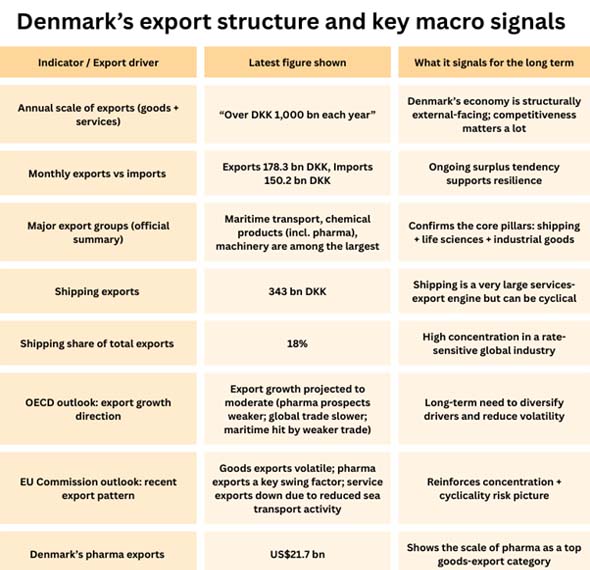

Denmark is one of Europe’s most export-oriented economies. In a typical year, the country sells well over DKK 1,000 billion worth of goods and services abroad, and monthly data consistently show exports running above imports, supporting an external surplus.

As per Denmark Import Data by Import Globals, the “export machine” matters not just for growth, but for wages, investment, tax revenues, and Denmark’s ability to finance ambitious priorities—green transition, welfare services, and a rising defence burden—without destabilising public finances.

What makes Denmark’s export model unusual is its mix of “hyper-competitive niches” rather than a broad, commodity-like base. A handful of world-class clusters (life sciences, maritime transport, energy/green tech, and high-quality food manufacturing) do much of the heavy lifting. This creates strong earnings power—but also concentration risk. As per Denmark Export Data by Import Globals, over the long term, Denmark’s outlook will depend on how well it diversifies export drivers while maintaining leadership in its core strengths.

The Export Engines that Shape the Long-Term Outlook

Denmark’s external performance is best understood as four pillars:

1) Life Sciences (Pharma and Biotech)

According to Denmark Import Export Trade Data by Import Globals, pharmaceutical exports have grown rapidly over recent years and have become a key driver of overall export volatility—strong upswings create big national tailwinds, while slowdowns can quickly show up in trade and GDP data. The long-term question is not whether life sciences remain important (they likely will), but whether Denmark can broaden the base within life sciences—more firms, more therapeutic areas, more advanced manufacturing—so the national cycle is less dependent on a narrow set of products and companies.

2) Maritime Transport and Shipping-Related Services

Shipping is frequently described as Denmark’s largest export industry in services terms, and it can account for a very large share of total exports. As per Denmark Import Custom Data by Import Globals, this sector is globally competitive but also cyclical: freight rates, geopolitical disruptions, and global trade volumes can swing earnings and export values significantly year to year.

3) Green Energy and Industrial Decarbonisation Solutions

Denmark’s long-term opportunity set is strongly linked to global decarbonisation. Offshore wind capabilities, grid integration know-how, industrial efficiency solutions, and clean-tech services can become increasingly “exportable” as countries build renewable capacity and electrify industry. As per Denmark Import Trade Analysis by Import Globals, this pillar also supports Denmark’s resilience: it ties exports to multi-decade global investment trends rather than short product cycles.

4) High-Quality Food and Advanced Manufacturing

Food products (notably high-value processed food and meat products) remain meaningful export anchors. Meanwhile, Denmark’s broader manufacturing base—machinery, electronics, measurement equipment, and specialised industrial goods—adds depth. As per Denmark Exporter Data by Import Globals, these sectors tend to be steadier than shipping and less concentrated than pharma, but they still face competition, cost pressures, and regulatory changes.

What the Next Decade is likely to Look Like: the “Base Case”

A realistic base case for Denmark’s export-driven economy is continued external surplus strength but with greater variability from two sources: life sciences cycles and maritime cycles.

As per Denmark Importer Data by Import Globals, life sciences will likely remain a structural advantage because ageing populations, chronic disease prevalence, and global healthcare spending trends are durable. Pricing pressure, and changes in the product cycle can quickly affect the growth profile.

Shipping will still be important around the world, but it is vulnerable to changes in international trade, container market cycles, energy prices, and political problems along important routes.

In this base case, Denmark’s long-term growth stays solid, but it becomes more dependent on how well domestic policy and business investment broaden the export mix—especially toward green tech and advanced industrial services.

Upside Scenario: Denmark becomes a “Green-and-Health Powerhouse”

As per Denmark Import Trade Statistics by Import Globals, Denmark’s best upside path is one where it keeps leadership in life sciences while scaling green exports so that energy transition solutions become the second major, less cyclical growth engine.

In this Scenario:

Denmark exports more offshore wind-related engineering, grid integration services, and industrial electrification solutions. As per Denmark Import Shipment Data by Import Globals, companies monetize not only hardware but also maintenance, digital monitoring, optimisation, and lifecycle services—the “services wrapper” around green infrastructure.

Life sciences expands into broader biomanufacturing capacity, contract manufacturing, and new therapy areas, reducing single-product dependency. The result would be a more stable export profile: As per Denmark Import Export Trade Analysis by Import Globals, even if shipping dips in a weak global trade year, green and health exports can sustain momentum.

Downside Scenario: Concentration Risk Bites

The biggest long-term vulnerability is over-dependence on a narrow set of export drivers, especially if two things happen at once: a pharma growth slowdown and a shipping downturn. Because both are large, simultaneous weakness can materially affect GDP growth, fiscal revenues, and business investment.

Key Downside Triggers Include:

As per Denmark Export Import Global Trade Data by Import Globals, a sharper-than-expected shift in global pharma pricing or reimbursement, faster competitive displacement in key therapy areas, trade barriers or tariffs that hit sensitive categories, a prolonged global trade slowdown that reduces maritime transport activity and earnings.

This is exactly why diversification is not just an industrial strategy—it’s a macro stability strategy. Structural forces that shape Denmark’s competitiveness.

1) Labour Supply and Demographics

Denmark’s long-term competitiveness will depend on sustained labour participation and the ability to attract skilled workers. Tight labour markets raise costs, but they also push productivity investments—automation, digitalisation, and higher-value service exports.

2) The Speed of Productivity and Regulation

When investment approvals, infrastructure deployment, and permitting keep up with changes in technology, export-led economies do better. Over the long run, smoother regulatory processes can be a competitiveness edge—especially for energy projects and network infrastructure.

3) Fiscal space and the “Import Leakage” Problem

Denmark has strong public finances and can invest in long-term priorities. But some spending (notably defence-related procurement) has high import content, which can reduce domestic multiplier effects. That makes export competitiveness even more important for sustaining growth and budget balance.

What Businesses and Analysts should Watch

If you want a practical “dashboard” for Denmark’s long-term outlook, focus on these signals:

Export Concentration Metrics: how much total export growth is explained by pharma and shipping. Service export trend vs maritime activity: whether service exports broaden beyond sea transport.

Green Investment Pipeline: offshore wind, grid, Power-to-X, industrial decarbonisation projects and export contracts.

Market Access Risks: regulatory changes and tariff risk in major partner markets, especially for high-value categories.

Conclusion

Denmark’s export-driven economy has strong long-term foundations: world-class life sciences, globally competitive shipping services, and a credible platform in green solutions and advanced manufacturing. The challenge is that its biggest engines—pharma and maritime—can also introduce volatility. The most resilient long-term path is diversification: expanding green and industrial-service exports, broadening the life sciences base, and making the export mix less sensitive to a single product cycle or freight-rate swing. If Denmark succeeds, it can remain one of Europe’s strongest “small, rich, export powerhouses” over the next decade. Import Globals is a leading data provider of Denmark Import Export Trade Data.

FAQs

Que. Why is Denmark’s economy considered export-driven?

Ans. Because exports of goods and services are extremely large relative to the size of the domestic economy, and Denmark often runs an external surplus.

Que. What is Denmark’s biggest export risk long term?

Ans. Concentration and volatility—especially dependence on pharma cycles and maritime transport cycles at the same time.

Que. Can green tech meaningfully diversify Denmark’s exports?

Ans. Yes. Global decarbonisation is a multi-decade investment trend, and Denmark has capabilities that translate into exportable equipment, engineering, and services.

Que. Does strong public finance guarantee strong growth?

Ans. It helps, but Denmark still needs competitiveness. Some public spending has high import content, so long-term growth still relies heavily on export performance.

Que. Where to get detailed Denmark Import Export Global Data?

Ans. Visit www.importglobals.com.