- Feb 17, 2026

South Korea-United Kingdom Free Trade Agreement 2025: What Exporters Need to Know

In December 2025, the UK and South Korea finished talks to update their free trade agreement. This made important rules for today's supply chains and services delivered over the internet more up to date.

Why this is Important in 2025–2026

As per South Korea Import Data by Import Globals, for exporters, the upgrade is less about "headline tariff cuts" (many tariffs were already preferential) and more about making things more certain, making rules of origin easier to understand, and giving exporters more access to markets, especially for services, data-enabled trade, and complex manufactured goods that use inputs from more than one country.

The main point for big exporters is that the new deal is meant to lower "paperwork friction" and get rid of uncertainty that could have made costs go up for a big part of the UK–Korea goods trade. It will also make things clearer for tech, finance, and professional services.

The business setting: A Quick Look at UK–Korea Commerce

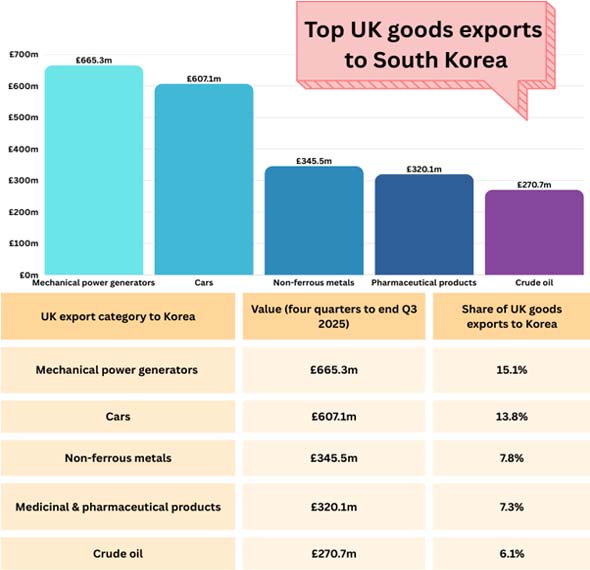

The UK–Korea relationship is still important for business, even though the world is unstable and demand cycles change. As per United Kingdom Import Data by Import Globals, the UK sells almost as many commodities as services to Korea. The UK usually has a surplus in services. These data are important because they demonstrate where the agreement will have the most effect in the real world: exporters of vehicles, machinery, pharmaceuticals, and business and financial services will benefit the most from clearer rules and fewer non-tariff obstacles.

What Changed in the 2025 Update (in Simple Terms for Exporters)

1) Certainty About Tariffs: "Locked in" Access to Most Tariff Lines

As per South Korea Export Data by Import Globals, one of the main goals of the upgrading is to get long-term, tariff-free or discounted access to most of the Korean tariff lines that are important to UK exporters. In effect, this lowers the chance that items that are currently getting preferential treatment would suddenly have to pay new tariffs because of old or expired rules. What this means for exporters is that prices become more stable and long-term contracts (for distribution, OEM supply, and aftersales) can be signed with less danger of "tariff shock."

2) Rules of origin (RoO): The Biggest Operational Win for Manufacturers

Many exporters use RoO instead of tariffs to assess if a deal is good. As per United Kingdom Export Data by Import Globals, the upgrade updates the standards for determining the origin of goods so that enterprises that use inputs from more than one country can still get preferential treatment more easily. This is how modern production works (for example, in the automobile, electronics, chemicals, medical devices, and clothing industries). For exporters, this means that more products may get preferences without having to spend a lot of money on redesigning bills of materials.

It is easier for companies that assemble in the UK to follow the regulations if they use a combination of UK, EU, and third-country inputs (as long as the product rules are followed). Less likely to have your preference refused because of borderline origin calculations. You should now map your best-selling items to their HS codes and double-check the guidelines for each product, especially if you use a lot of non-UK inputs.

3) Digital Trade & Paperless Processes: Faster, More Predictable Cross-border Workflows

As per South Korea Custom Data by Import Globals, the upgrade adds new digital trade rules that are supposed to make doing business across borders easier. These include recognizing electronic contracts and signatures and making it easier for data-enabled trade to happen.

This is a big step forward for people who sell digital services, software, platforms, and "goods + digital" bundles (such connected devices, remote monitoring, and subscriptions). It also concerns to exporters of traditional commodities because customs and paperwork are becoming more and more computerized. For exporters, this means that there will be less problems with e-invoicing, e-contracting, and digital delivery models that are linked to real commodities.

4) Services Access: A Bigger Deal Than Most Goods Exporters Realise

It's not just containers and automobiles that the UK and Korea deal in; services make up a big part of their exports. As per United Kingdom Custom Data by Import Globals, the new agreement makes it easier for financial services, insurance, professional services, and other business services to do business by lowering barriers and making things more clear.

If you offer services directly to Korea (or "attach" services to commodities you send there), the update can assist you:

- Eexpand delivery models (cross-border supply, remote advice, aftersales support),

- Lower ambiguity about compliance,

- And compete better with providers who follow trade rules that are more up-to-date.

5) Government Procurement and Regulated Markets: More Doors for Qualified Suppliers

Better pledges and clearer rules can make it easier to get public-sector jobs and use regulated procurement channels. As per South Korea Trade Data by Import Globals, this is especially important for engineering, infrastructure-related services, construction design, specialized manufacturing, and consultancy. As an exporter, you should think of Korea as a structured bid market instead of a "one-off distributor market." In this market, local partners, certifications, and being ready to bid are all important.

A Useful List of Things to Do for Exporters in 2026

Step 1: Re-Qualify your Products According to the New RoO

- Find your top 20 SKUs based on how much money they could make in Korea.

- Check the HS codes and the guidelines about where each product comes from.

- Create a clean "origin evidence pack" that includes supplier declarations, a costed BOM, and manufacturing records.

- Decide whether to claim preference at shipment level or only on major lanes initially.

- A common mistake is thinking that last year's RoO technique still works. Changes to even "small" rules can change who is eligible.

Step 2: Change Contracts, Incoterms, and the Way Paperwork is Done

If the upgrade makes e-contracting and modern customs cooperation stronger, use it to your advantage by switching to digital-first documentation packages.

- Make product descriptions and HS classifications more precise,

- Make sure your Korean buyer or distributor can support preference claims when they come in.

- A common mistake is when the exporter says they want preference but the importer doesn't have the right paperwork at clearance. This means that preference is refused.

Step 3: Think of Services as a Product, Not an Extra

If you sell machinery, medical technology, or engineered goods, your true profit often comes from maintenance contracts.

- Calibration,

- Training,

- Monitoring from afar,

- Subscriptions for software.

- Make a "Korea-ready" bundle with clear service scopes,

- Model for Korean-language help (even if it's sent from the UK),

- Data and cybersecurity posture in line with what enterprise purchasers want.

Step 4: Win in Korea by Following the Rules and Showing Trust

In regulated industries, Korea is focused on quality and following the rules. Strengthen: test reports and certifications,

- SLAs for warranties and after-sales service,

- Local partner agreements (for service centers, shipping, and returns).

- A common mistake is to enter a market with a price-led strategy without the service and quality infrastructure that is anticipated.

Step 5: Keep an Eye on the Timeline; Details About the Implementation Are Important

As per United Kingdom Trade Data by Import Globals, when new trade agreements come out, they often come with annexes, guidance notes, and administrative procedures that explain "how it works in practice." Exporters should keep an eye on: customs advice on the new RoO procedures,

- Explanations about market access for specific sectors (such financial services and data-enabled services),

- Any plans for products that are already in long-term supply contracts to move to new ones.

What Exporters Should Pay Attention to in Each Sector

Cars and Advanced Manufacturing

- RoO flexibility can be the deciding factor in whether or not vehicles and parts qualify.

- OEM supplier chains benefit from certainty and easier compliance with origin rules.

- When border processes are easier, aftermarket parts and service packages can grow more easily.

- Pharmaceuticals, life sciences, and products that are controlled.

- Tariff certainty is helpful, but getting to market quickly typically depends on regulatory processes, the quality of documentation, and partnerships in the area.

- If you sell diagnostic tools, equipment, or special chemicals, think of compliance as your "market access product."

- Food and drink (premium) Korea has a highly developed consumer market where branding, origin, and distribution are just as important as tariff choice. Import Globals is a leading data provider of United Kingdom Import Export Trade Data.

- Before growing, make sure that labels, ingredients, and SPS compliance processes are all locked.

Money, Insurance, and Professional Services

The improvement makes the platform stronger for cross-border distribution and operational certainty. Start building local relationship capital early; Korean business clients seek continuity and proven ability.

One Statement About What "Exporters Need to Know"

The updated UK–South Korea FTA for 2025 is a practical modernization that protects market access, makes rules of origin easier to use, and strengthens conditions for high-value and digitally delivered services. The companies that can turn legal text into clear product qualification, documentation discipline, and Korea-ready go-to-market execution will be the winners in 2026. Import Globals is a leading data provider of South Korea Import Export Trade Data.

FAQs

Que. Will my goods now be free of tariffs?

Ans. Not right away. A lot of lines were previously preferred, and eligibility still depends on following the rules of origin and having the right paperwork.

Que. What is the most crucial thing for exporters to do?

Ans. Check the rules of origin for your HS codes again and fix your preference-claim process so that your importer can clear successfully.

Que. If I sell services instead of things, does the upgrading matter?

Ans. Yes. Provisions for services and digital trade can make cross-border delivery, contracting, and regulatory transparency more certain, especially for business and financial services.

Que. Where in Korea do UK exporters have the most business right now?

Ans. Recent data suggests that machinery and power generators, autos, non-ferrous metals, pharmaceuticals, and a lot of business and financial services are doing well.

Que. Where to get detailed United Kingdom trade data or South Korea Export Data?

Ans. Visit www.importglobals.com.