- Jun 03, 2025

Tea Exports of Kenya in 2024: Unlock the Latest Trends and Strategies

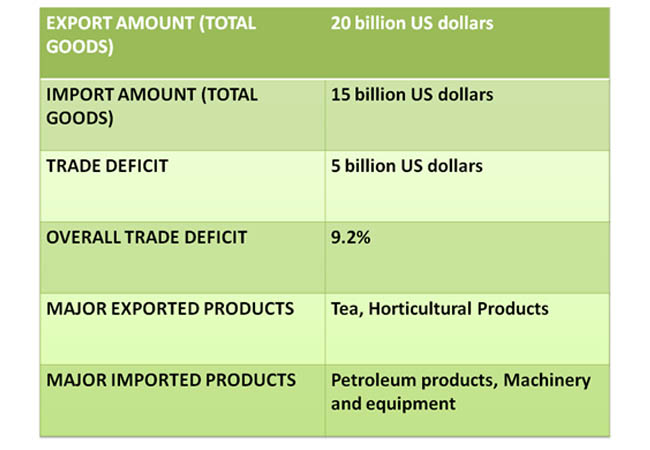

The export volume increased by 14%, i.e. around 594.5 million kg from the staggering export volume of 522.92 million kg of tea in 2023; Despite the sturdy rise in the growing global demand for tea, the average export price per kg declined to 2.27 billion US dollars due to some economic factors and currency fluctuations. Different government initiatives taken by the authority like the removal of value-added tax and establishment of China-Kenya Tea Trade Centre are some of the contributing factors holding an annual trade share of 10% increase in value-added tea exports.

The economic recession in key markets like Russia, Sudan, Pakistan, and Egypt, and the foreign exchange constraints and political instability, has led to a total export value of tea worth 1.5 billion US dollars in 2024. The crucial impact of vessels in the Red Sea region, due to recession in the global trade route and the Kenyan government implemented measures are to stabilize the trade prices, and to reduce unsold stocks, has boosted the annual valuations.

The Importance of Tea Exports in Kenya's Economy of 2024

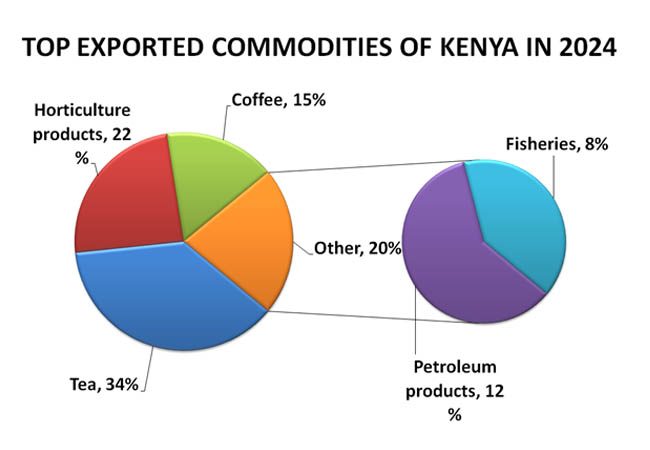

Tea exports remained a stronger base structure to the growing economy of Kenya, solidifying its critical role in national development and foreign exchange earnings. Kenya's leading export commodity tea has accounted for around 84% of the total tea industry earnings of ksh. The GDP contribution was around 4% and 26% of the country's total export earnings. The technological evolution of the manufacturing units has increased the employment rate to over 5 million people residing in the nation. The extensive reach to rural areas has indulged the commodity as a vital source of income and economic activity in regions with limited employment opportunities.

The growth rate in the global demands due to the high-quality production of the manufacturing unit and the implementation of VAT over the traded goods accounts for a 20% overall hike in tea exports from Kenya. The vast production capacity stabilizes the import rate by reducing the reliance on foreign traders for domestic tea acquisitions, balancing the trade rate up to a great extent, and countering the solidifying rank among other global competitors.

A Brief Overview of Kenya's Trade of 2024

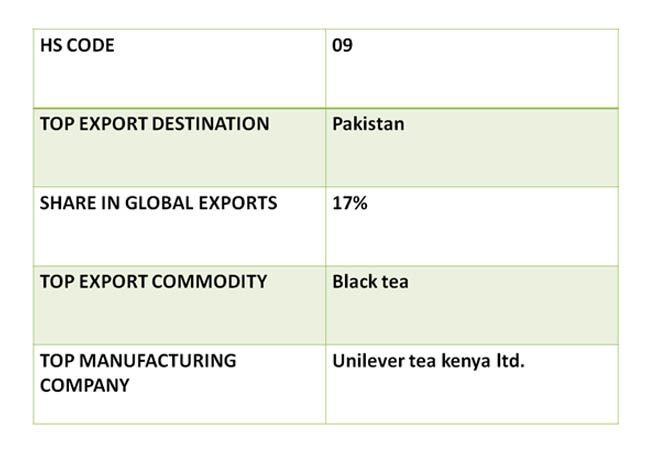

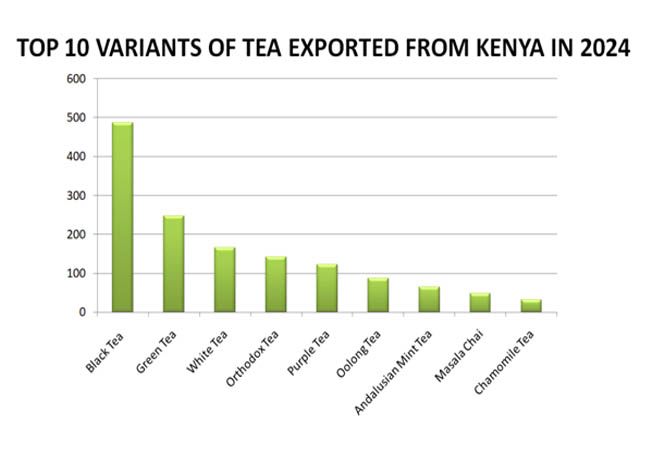

Kenya has solidified its position as one of the largest tea exporters across the globe with its robust performance despite the global economic and logistical challenges. The hype in the production rate and the strategic pricing ranges afforded are the attributing factors behind the increasing exports. According to the Kenya Export Data, the top 10 leading export variants of tea from the nation in 2024 are,

1. Black Tea - Export valuation - 486 million US dollars: Annual trade share - 32%

2. Green Tea - Export valuation - 248 million US dollars: Annual trade share - 22%

3. White Tea - Export valuation - 165 million US dollars: Annual trade share - 16%

4. Orthodox Tea - Export valuation - 142 million US dollars: Annual trade share - 12%

5. Purple Tea - Export valuation - 122 million US dollars: Annual trade share - 8%

6. Oolong Tea - Export valuation - 87 million US dollars: Annual trade share - 6%

7. Andalusian Mint Tea - Export valuation - 76 million US dollars: Annual trade share - 5%

8. Masala Chai - Export valuation - 65 million US dollars: Annual trade share - 4%

9. Chamomile Tea - Export valuation - 48 million US dollars: Annual trade share - 3%

10. Hibiscus Tea - Export valuation - 32 million US dollars: Annual trade share - 1.5%

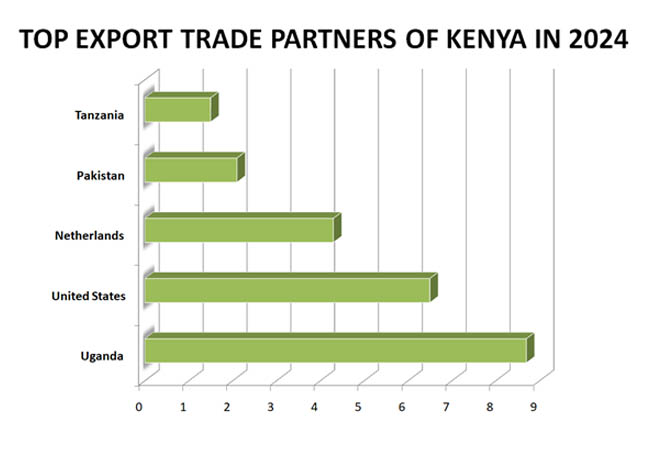

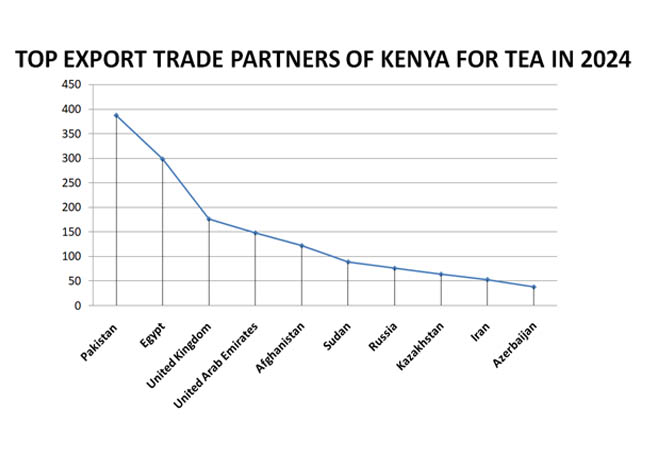

Major Export Trade Partners of Kenya for Tea in 2024

Kenya's tea export has been serving as a backbone to the entire export economy with a revenue share of more than 25%. The growth rate in the emerging markets demand, such as South Sudan and other countries, has been fostering the annual trade rate. According to the Kenya Trade Data, the top 10 export trade partners of the nation for tea export in 2024 are,

1. Pakistan - According to the Pakistan Import Data, the total valuation of tea exported from Kenya in 2024 - 387 million US dollars.

2. Egypt - According to the Egypt Import Data, the total valuation of tea exported from Kenya in 2024 - 298 million US dollars.

3. United Kingdom - According to the United Kingdom Import Data, the total valuation of tea exported from Kenya in 2024 - 176 million US dollars.

4. United Arab Emirates - According to the United Arab Emirates Import Data, the total valuation of tea exported from Kenya in 2024 - 148 million US dollars.

5. Afghanistan - According to the Afghanistan Import Data, the total valuation of tea exported from Kenya in 2024 - 122 million US dollars.

6. Sudan - According to the Sudan Import Data, the total valuation of tea exported from Kenya in 2024 - 89 million US dollars.

7. Russia - According to the Russia Import Data, the total valuation of tea exported from Kenya in 2024 - 76 million US dollars.

8. Kazakhstan - According to the Kazakhstan Import Data, the total valuation of tea exported from Kenya in 2024 - 64 million US dollars.

9. Iran - According to the Iran Import Data, the total valuation of tea exported from Kenya in 2024 - 53 million US dollars.

10. Azerbaijan - According to the Azerbaijan Import Data, the total valuation of tea exported from Kenya in 2024 - 38 million US dollars.

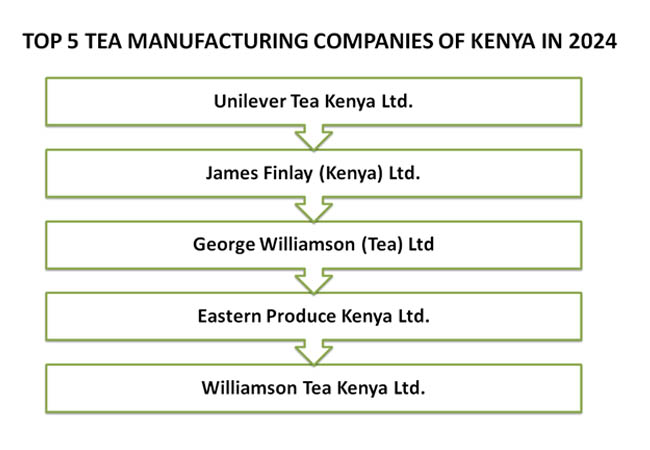

The Top 5 Tea Manufacturing Companies of Kenya in 2024

The tea export industry of Kenya has long been a supporting structure for the export economy. The sector's success is mostly driven by the combination of favorable weather conditions accompanied by strategic geographical location, government reforms, and the evolution of manufacturing units. As per the Kenya Customs Data, the top five tea manufacturing companies of Kenya in 2024 are,

1. Unilever Tea Kenya Ltd. - An Anglo-Dutch consumer goods company discovered in 1922; It is one of the most highly producing tea manufacturers in Kenya and among the top five largest food and beverage companies globally. It holds an annual trade share of 42% in the total tea exports.

2. James Finlay (Kenya) Ltd. - This Company, founded in the year 1913 is one of the six large-scale estates spread across different parts of Kenya, that accounts for 65 million kilograms of crushed-tear curled tea annually. It also produced high amount of other globally demanded acquisitions, holding an annual trade share of 22% in the tea exports.

3. George Williamson (Tea) Ltd. - George Williamson owns around 7 plantations across different altitudes ranging from high land to low land areas. The suitable fertility rate of the land area and the diversification in the range of teas are mostly due to the high-quality production via the technological evolution of farming practices. The company established in 1926 holds an annual trade share of 15% in the total tea exports of Kenya.

4. Eastern Produce Kenya Ltd. - It is a subsidiary of the Camellia PLC, which is a UK-based company, with over 150 years of experience in tea production. The company, operating three large-scale estates in Kenya, holds an annual trade share of 11% in the total tea exports.

5. Williamson Tea Kenya Ltd. - Wrapping up, Williamson Tea exports. Kenya Ltd., discovered in 1923, is one of the strongest tea manufacturers in Kenya with a diversifying export portfolio. The company, with ownership of six plantations in prime tree-growing areas, produces premium-quality orthodox teas and holds an annual trade share of 8.7% in total tea exports.

FAQ'S

Que. What is the export trade value of tea from Kenya in 2024?

Ans. The export trade value of tea from Kenya in 2024 is 1.5 billion US dollars.

Que. Name the top tea manufacturing company in Kenya in 2024.

Ans. Unilever Tea Kenya Ltd. is the top tea manufacturing company in Kenya in 2024.

Que. Who is the top export trade partner of Kenya for tea in 2024?

Ans. Pakistan is the top export trade partner of Kenya for tea in 2024.

Que. Where can you get a detailed trade analysis of the tea exports of Kenya in 2024?

Ans. By subscribing to Import Globals, you can get a detailed trade analysis of the tea exports of Kenya in 2024.