- Oct 08, 2025

Top 5 Ammonium Nitrate Exporting Countries: Trends, Data & Future Outlook

The foundation of contemporary intensive farming and an essential component of the mining and explosives industries is ammonium nitrate, a nitrogen-based chemical molecule.

Based on Sweden Import Data by Import Globals, due to its dual usage and strategic significance, ammonium nitrate trading is a delicate commodity under international attention and a significant economic engine. Despite discussions about the environment and security, ammonium nitrate will continue to be necessary as the global agriculture industry expands to feed a population expected to exceed 10 billion by 2050.

Today, its worldwide supply is dominated by Sweden, Bulgaria, the United States, Russia, and the European Union. However, due to geopolitics, sustainability demands, and new players looking to change the game, trade trends are changing.

Recognizing Ammonium Nitrate and Its Significance

Farmers who want effective soil enrichment select ammonium nitrate (NH4NO3) due to its high nitrogen content and quick-release characteristics. Industrial explosives for quarrying, building, and mining are also made there. However, strict international restrictions, licensing requirements, and transportation prohibitions have been prompted by its possible abuse in the production of bombs.

The largest issue for both importers and exporters continues to be striking a balance between national security and agricultural demands. As per USA Export Data, Governments and manufacturers have also been forced to develop safer formulas and substitute chemicals as a result of recent accidents and the need for greener fertilizers.

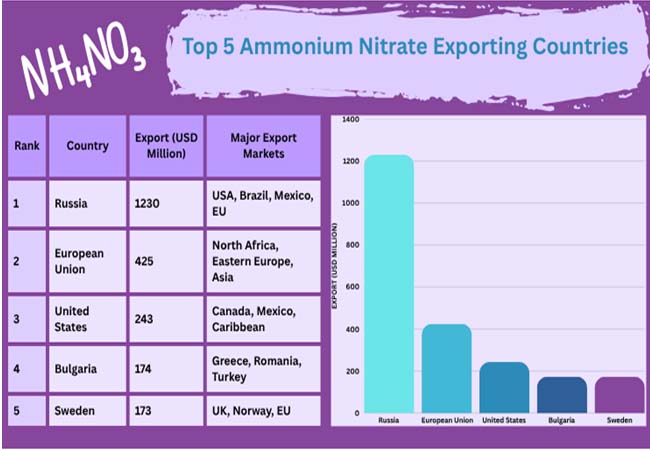

An Overview of the Top Exporters

Russia

Russia continues to dominate the trade in ammonium nitrate. As per Russia Import Export Trade Data by Import Globals, Russia was responsible for almost 40% of the world's ammonium nitrate exports in 2023, with an export value of around USD1.23 billion (OEC). Uralchem, EuroChem, Acron Group, and TogliattiAzot, its leading producers, have supply systems that date back decades, connecting Siberian gas reserves to ports such as St. Petersburg and Murmansk.

Despite recent sanctions and geopolitical tensions straining this flow, the United States continues to be one of Russia's largest clients. Due to its affordable prices and consistent supply, Russian ammonium nitrate is also used by nations in Latin America, Africa, and some parts of Asia.

The European Union

According to Import Globals’ Europe Import Data, the European Union as a whole exported ammonium nitrate worth an estimated USD425 million in 2023. Although there is a lot of internal commerce between EU nations like Poland, Lithuania, Belgium, and the Netherlands, exports also go to Eastern Europe, the Middle East, and North Africa.

The market is dominated by fertilizer manufacturers like Yara International and Grupa Azoty, who profit from their proximity to ports with a worldwide reach and industrialized agricultural regions.

America

About USD243 million worth of ammonium nitrate was delivered by the US in 2023, making it the third-largest exporter in the world (WITS). As per USA Import Trade Analysis by Import Globals, leading American companies such as CF Industries control the domestic market while exporting to the Caribbean, Canada, and Mexico. The United States imports a lot, mostly to offset seasonal demand surges, even though it exports a lot.

The ammonium nitrate trade in the United States is one of the most closely watched in the world due to strict safety restrictions.

Bulgaria

With USD174 million in exports last year, as per Bulgaria Export Data by Import Globals, Bulgaria's chemical sector has developed into a dependable center for ammonium nitrate in Eastern Europe (WITS). Shipments to Turkey, Greece, and the Balkans are made easy by the Black Sea port of Varna and efficient rail connections.

Because businesses like Agropolychim guarantee superior manufacturing that complies with EU standards, Bulgarian ammonium nitrate is a desirable choice for customers in the area.

Sweden

Based on Sweden Import Data by Import Globals, Sweden is notable for producing high-quality, specialized ammonium nitrate (WITS), with an export value close to USD173 million. Thanks to businesses like Kemira and Yara Sweden, its output benefits Europe's mining industry as well as agriculture. Sweden produces fertilizer more sustainably than many of its international rivals thanks to its clean energy mix.

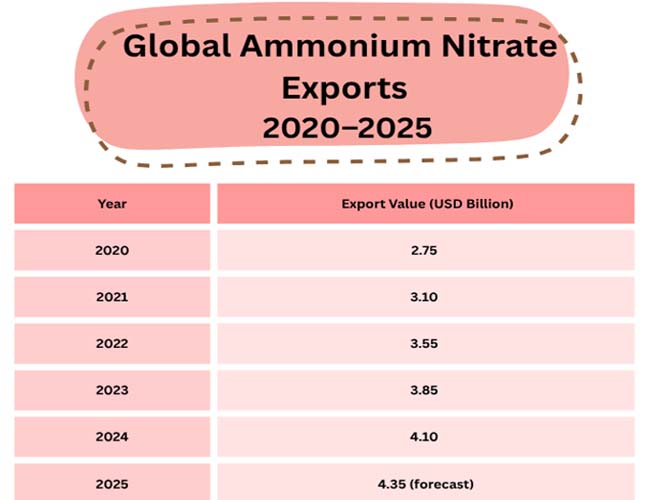

Global Ammonium Nitrate Exports: 2020–2025

Below is a snapshot of global ammonium nitrate export values from 2020 to 2025. These figures help illustrate how the trade has weathered supply chain disruptions, energy crises, and policy changes:

New Players & Upcoming Changes in Supply

Other nations are increasing their production and export capabilities of ammonium nitrate, while the top five exporters remain stable. To compete regionally, South Korea, South Africa, Georgia, and Uzbekistan are renovating their existing facilities and building new ones.

As per Georgia Import Trade Statistics by Import Globals, Georgia, for instance, is a noteworthy new entry into the top 10 with ammonium nitrate exports that have increased to around USD158 million. While looking into new export routes to Asia, African nations like South Africa are also putting themselves in a position to meet their own mining and agricultural needs.

Trade Obstacles for Ammonium Nitrate

Based on Russia Import Export Global Data, the increasingly stringent regulatory environment is one of the largest obstacles facing exporters. Governments are enforcing more stringent regulations on ammonium nitrate due to its association with significant explosions and its misuse in homemade explosives. International shipping norms were reviewed in the wake of events such as the 2020 Beirut Port explosion. These days, many ports demand digital paperwork, secure packaging, and sophisticated tracking.

Concurrently, farmers and fertilizer manufacturers are being prompted by environmental concerns to think about alternatives such as controlled-release fertilizers that lower nitrogen runoff and urea-ammonium nitrate (UAN) solutions.

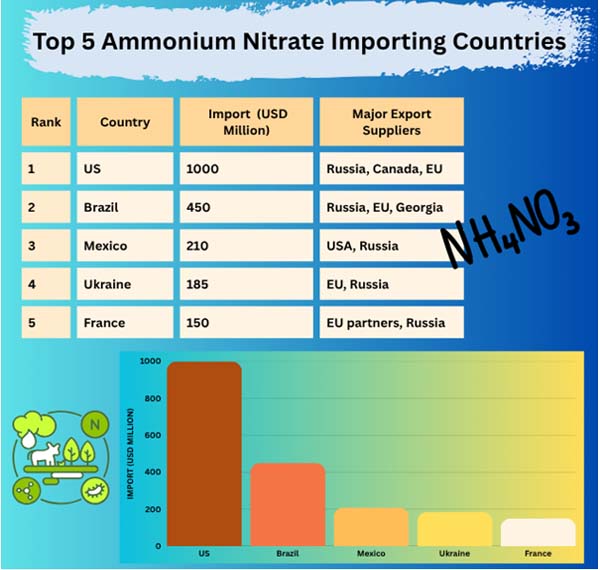

Who Buys the Most in Important Import Markets?

The United States, Brazil, Mexico, France, Ukraine, and portions of Southeast Asia are among the nations that are boosting demand for ammonium nitrate. Based on Brazil Import Data by Import Globals, Nitrogen-rich fertilizers are necessary for Brazil's burgeoning sugarcane and soybean industries to sustain yields on expansive farmlands. Ammonium nitrate is imported by Mexico for use in mining and agriculture. France imports an extra supply to meet seasonal peaks even though it produces its own.

The OEC reports that in 2023, the U.S. alone imported over USD1 billion worth of ammonium nitrate, making it the world's largest importer and third-largest exporter. This unique balance is influenced by pricing and transportation.

The Path Ahead for Innovation and Sustainability

The market for ammonium nitrate must strike a balance going forward. On the one hand, nitrogen fertilizers are essential to ensuring harvests and meeting the growing demands of the global food supply. On the other hand, producers are under pressure from governments and environmental organizations to lower carbon emissions and nitrogen runoff, which can deteriorate soil and pollute water.

Carbon-neutral industrial facilities, intelligent fertilizer application, and precision agriculture are examples of innovations that are quickly becoming the norm in the business. Based on Europe Import Export Trade Analysis by Import Globals, the fact that producers in North America and Europe are already making investments in cleaner feedstocks and green ammonia indicates that sustainability will influence ammonium nitrate's future just as much as trade agreements and geopolitics.

Conclusion

The function of ammonium nitrate in the world economy is more complicated than that of a typical fertilizer product. In addition to being an industrial engine for mining and construction, it is an essential component of the food security chain. Russia, the EU, the U.S., Bulgaria, and Sweden continue to serve as the global supply chain's anchors as trade flows change in response to changing geopolitics, more stringent safety standards, and environmental concerns.

These five continue to be the titans of ammonium nitrate exports, but who survives will depend on emerging exporters, green technologies, and trade diversification.

Import Globals is a leading data provider of Russia import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. Is ammonium nitrate safe to transport internationally?

Ans. Yes, but it is heavily regulated. Ports and shipping lines follow strict packaging and handling guidelines to prevent accidents and misuse.

Que. Why do countries like the U.S. export and import ammonium nitrate simultaneously?

Ans. Seasonal demand, price arbitrage, and regional supply gaps mean the U.S. both produces and buys large quantities to balance its needs cost-effectively.

Que. What are the environmental concerns with ammonium nitrate?

Ans. Excessive use can lead to soil acidification and nitrogen runoff, which can pollute water bodies and contribute to greenhouse gas emissions.

Que. Who are the new players in ammonium nitrate exports?

Ans. Countries like Georgia, Uzbekistan, and South Africa are expanding their production to tap into regional markets in Europe, Asia, and Africa.

Que. Where can you obtain detailed Ammonium Nitrate Export Import Global Trade Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.