- Dec 08, 2025

What Are the Current and Future Trends in Ukraine's Cereal Exports?

Because it is so important to the world's food supply, people have termed Ukraine the "breadbasket of Europe" for a long time.

As per Ukraine Import Data by Import Globals, it has a lot of land, black soil that is suitable for growing, and a long history of farming; thus, it is one of the biggest cereal producers in the world. Even though the war has made things harder, Ukraine still sends millions of tons of crops to other countries. Most of these grains are wheat, corn, and barley. This has a big impact on food prices and safety all around the world.

This blog is about the grains that Ukraine sends to other countries. It talks about how well they do, where they sell them, the problems they have with logistics, and what the future holds for this important industry.

A study of Ukraine's Grain Exports for 2024 and 2025

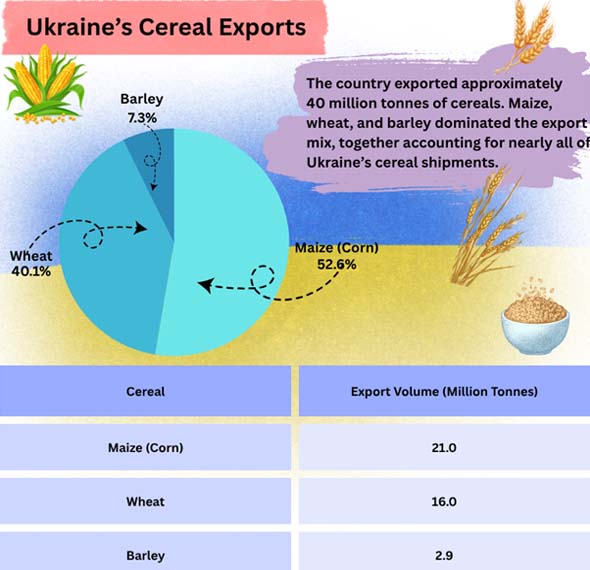

There were still problems, but Ukraine's cereal exports did well in the marketing year 2024/25 (July to June). As per Ukraine Export Data by Import Globals, the government sent out about 40 million tons of grains, which is still less than it used to send out before the war. Ukraine's principal exports were corn, wheat, and barley.

Things That Have a Big Impact on Ukraine's Cereal Exports

Every year, three elements determine Ukraine's grain exports; how much is made, how simple it is to get to ports and convey commodities, and how demand varies across the world.

1. How Much is Made

The weather, the availability of farming tools, and the ability to plant and harvest in places where there has been violence all have a big effect on how much is made. As per Ukraine Import Export Trade Data by Import Globals, yields have gone down over the past few years since there isn't enough fertilizer, mined land, or personnel to hire. Ukrainian farmers have been very adaptable, utilizing a variety of strategies to grow crops and make the most of the land they have.

2. Getting to the Port and making Plans for the Trip

Before the war, Ukraine shipped a lot of grain to other countries through Black Sea ports, including Odesa, Chornomorsk, and Pivdennyi. But the conflict destroyed these critical roads, thus the country had to change. As per Ukraine Import Custom Data by Import Globals, the rail, road, and water networks in Romania, Poland, and the Danube region became more and more significant. Even if prices rose, these new pathways made sure that items still got to purchasers in other nations.

3. Prices and Demand are Competitive all Across the World

People all throughout the world still seek Ukrainian grains because they are cheap and taste nice. As per Ukraine Import Trade Analysis by Import Globals, Egypt, Indonesia, and the EU still want to import wheat and corn from Ukraine. At the same time, buyers from Africa and Asia are becoming more prominent.

Countries that get a lot of grains from Ukraine

Ukraine sells things to several regions, such as Europe, Asia, Africa, and the Middle East. For a long time, the European Union has been a big buyer of barley and wheat. As per Europe Exporter Data by Import Globals, things have changed in the last few years, and a number of Asian and African countries have become more interested.

- The European Union, especially Spain, Italy, and the Netherlands, bought the most grains from Ukraine in the 2024/25 marketing year.

- Egypt has been obtaining wheat from Ukraine for a long time to feed its people. Vietnam and Indonesia are two of the most famous Asian countries that acquire grain from Ukraine.

- Morocco and Algeria are two of the biggest buyers from North Africa. Ukraine is supplying China with an increased quantity of barley and other cereals.

As per Ukraine Importer Data by Import Globals, Ukraine has been able to keep its exports steady, even while its usual trade channels were stopped, because of this diversification.

What the Black Sea Grain Corridor is For

The Black maritime Grain Initiative, which started in 2022, made it safe for some maritime channels to let Ukrainian farm goods pass through. This deal was very significant for keeping food prices consistent around the world and making sure that countries that need to buy food don't run out.

Even after the program ended, Ukraine began building its own marine route. This made sure that the navy could help ships safely cross the Black Sea. As per Ukraine Import Trade Statistics by Import Globals, this strategy is still highly vital for keeping export levels high, even though shipping costs and insurance rates have gone up.

By 2024/25, more than two-thirds of all cereal exports from Ukraine went by sea. The others came into the country through the Danube and the railroads and highways that traverse through Europe.

What to Look Out for and Expect When Exporting

1. Steady, Although not at its Greatest Level

As per Europe Import Shipment Data by Import Globals, Ukraine shipped about 40 million tons of grain to other nations in 2024 and 2025. But it's still a lot. It was normal to send 55 to 60 million tons before the war. This constant performance indicates how solid the farming business is.

2. What to Look Forward to in 2025 and what could go Wrong

By 2025, the amount of grain made around the world could drop by as much as 10%. The main reason for this is that there isn't enough fertilizer, and the weather isn't helping. If this happens, it may be harder to get goods for export. This would mean that cereal shipments would go down a little bit in the next year of marketing.

3. Changes in the Market

The geography of what Ukraine sells to other countries is always changing. The EU is still a very important consumer, but Asia and Africa's shares have grown. As per Ukraine Export Import Global Trade Data by Import Globals, Ukraine is expected to expand this diversification as it looks for safe, long-term markets outside of its borders.

Issues with Ukraine's Grain Exports

Things are getting better, but Ukraine's cereal export system still has big problems:

Safety Risks: Ports, roads, and storage areas are always under risk because the fighting is still going on. Shipping and insurance costs for ships that come into Ukrainian ports remain expensive. When you can't buy affordable tools and fertilizers, work isn't as fruitful. When roads, train lines, and silos are destroyed, it's hard to move grain.

Uncertainty in International Politics: Changes to treaties or sanctions could make trade work in ways that are not expected.

How important are Ukrainian Grain Exports to other Countries?

Everyone in Ukraine must have enough food. Many countries with low or intermediate incomes depend on their cheap grains to feed their people. When Ukraine's exports go down, like they did in 2022, the price of food in countries that depend on imports often goes up. By exporting wheat and other grains, Ukraine also helps keep prices consistent around the world. In Africa, this makes bread more expensive, while in Asia, it makes cattle feed more expensive.

What will Transpire Subsequent to 2025?

In the future, Ukraine's cereal exports will be influenced by the following critical factors -

In order to facilitate water access, Ukraine must continue to endeavor to improve the safety of the Blackwater and trade routes, as per the Ukraine Import Export Trade Analysis by Import Globals.

Investing in Infrastructure: Better trains, silos, and port terminals will make it easier to export goods and save money.

Input Supply and Modernization: Regularly bringing in fertilizer and employing new farming tools would help crops grow more.

Market Growth: Demand will be steady, even if demand in Europe shifts if you create greater ties with markets in Asia, Africa, and the Middle East.

If these issues are fixed, Ukraine could be able to slowly get back to the level of exports it had before the war in a few years.

Last Thoughts

Ukraine's cereal exports are still a very important element of the world's food supply. The country has been able to keep up high levels of exports even while there is still fighting going on. This has been accomplished because of strong farmers, clever planning, and new methods of doing things.

Ukraine still supplies roughly 40 million tons of wheat to its neighbors every year, even in 2024/25. This is a big deal, considering how bad things were. In the next three years, Ukraine will have to fix up its farming infrastructure and make sure it can still get to markets. But it will still be a large part of the world grain trade for a long time since it lasts so long. Import Globals is a leading data provider of Ukraine Import Export Trade Data.

FAQs

Que. How many cereals does Ukraine export to foreign countries each year?

Ans. In the marketing year 2024/25, Ukraine sent more than 40 million tons of wheat to other countries. These were corn, wheat, and barley.

Que. Which nations buy the most crops from Ukraine?

Ans. Some of the top importers are Egypt, Indonesia, Algeria, Vietnam, China, and the EU.

Que. What are the greatest problems with Ukraine's cereal exports?

Ans. Some of the major problems include security challenges at ports, high insurance costs, damage to infrastructure, and not enough fertilizer.

Que. Will Ukraine's exports ever reach the same level they were at before the war?

Ans. Yes, Ukraine can get back to exporting the same amount of goods it did before the war in a few years if port safety gets better, infrastructure is rebuilt, and the supply of inputs continues consistent.

Que. Where can you obtain detailed Ukraine Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.